If you’re struggling with debt, it’s likely that bailiffs will be knocking on your door. But don’t panic! You can stop this from happening by taking control of your finances and making sure that you don’t owe any money.

What is a bailiff?

A bailiff is a person who is employed by creditors to collect debts. They will visit your home, or call on you at work, unannounced and with no prior warning. A bailiff can’t force entry into your home unless it’s for an emergency reason such as fire or flooding — in which case they’ll have to get permission from the local council first before entering your property.

A bailiff cannot take things that aren’t yours: they cannot take items such as TVs or computers if they’re not listed on their list of assets (this includes items left behind when someone died). A creditor may only recover money owed once after contacting all other possible sources first including people who owe money directly through bank accounts/credit cards etc.

Bailiffs do not have any legal powers over protected property such as homes with burglar alarms; however if there has been an offence committed against this type of dwelling then an individual might be liable under trespass law (i) if they entered onto another person’s land without permission; ii) even if permission was given but still broke into someone else’s home unlawfully.

Can a bailiff enter my home?

The answer to this question is yes, but it’s not quite as straightforward as you might think. There are two types of bailiffs:

- A warrant officer (WO) is an employee of a court and can only issue warrants for arrest under section 1A(1) of the Criminal Justice Act 1925. They do not need permission from anyone else in order to enter your house; however, they will usually have written permission from the police constable who has issued the warrant. If there are children present at home then WOs must tell them about what’s going on before entering — although this doesn’t apply if someone else has already told them about it!

- A constable (PC) is employed by local authorities and can issue any sort of summonses that aren’t covered by criminal law — such as civil disputes between neighbours over parking spaces or garden gnomes. PC bailiffs often accompany their colleagues because they’re trained specifically in dealing with these kinds of cases; however, PC bailiffs are not allowed into private homes without prior notification unless those people agree otherwise firstly (usually because they’ve asked them).

What can bailiffs take from your house?

Bailiffs can take your possessions, but not your home. They will only go into your house if they have been served with a warrant of possession and are required to enter it. If you have moved house in the meantime and are a new resident at that address, bailiffs cannot enter without court permission (and even then only under certain conditions).

You may also want to consider whether you need more than just one item from the property being sold on your behalf by bailiff services — for example, if there are other debts outstanding against you which could be paid off by selling some items first instead of taking everything else away immediately when paying off this debt. If so then it may make more sense for those items not being sold initially by bailiff services until after those other debts have been settled rather than leaving them unpaid while trying quickly sell everything else first before dealing with anything else later down line once all payments had been made due before moving forward again toward paying back another debt entirely separate from what had already been paid off previously because otherwise then what would happen?

Can high court bailiffs force entry?

High Court bailiffs can force entry if they believe that it is necessary in order to serve the notice on you. They must follow the rules set out in the high court bailiff guidance, which says that:

- High Court bailiffs should only use force as a last resort.

- They must give you at least 24 hours’ notice before entering your home.

If I am struggling with debt how can I avoid having bailiffs at my home?

If you’re struggling with debt and need help, there are some steps that you can take to avoid bailiffs.

- Avoid using cards or overdrafts: If you have debts that are causing problems, it may be best to stop using your cards or overdrafts. This will help avoid having any more money taken from your bank account in order to pay off these debts.

- Keep a low balance on all of your accounts: The more money has been taken out of an account, the less chance there is of it being able to be repaid once again later on down the line (or at all). As such, keep track of what happens when bills go unpaid so that no one ends up having their wages garnished because they haven’t paid enough towards them yet!

You can stop bailiffs by getting control over your debts.

The first thing to do is to get control over your debts. This means that you need to start paying off all of your bills and payments that are due, as well as any other debts you have.

Bailiff companies will only come when they’ve been given proper notice by a creditor or bailiff company, but this doesn’t mean it’s impossible for them to visit without warning! You should also make sure all contact details are up-to-date with whoever has power over them (such as HMRC). If there’s no response after several attempts at contacting someone with authority over the debtor’s property then bailiffs may take whatever they can find — including things like computers and mobile phones.

How to stop bailiffs?

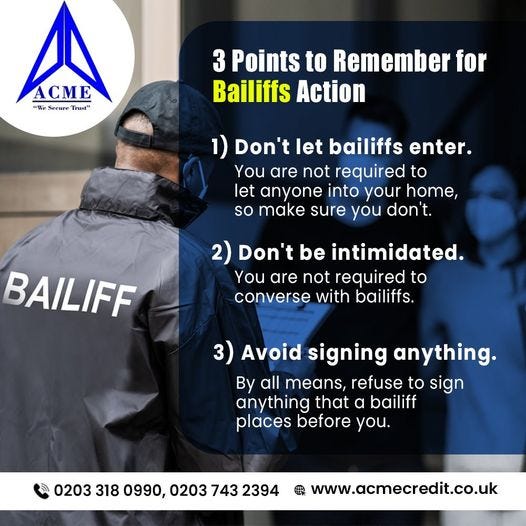

If you find yourself in the situation of being served with a bailiff, there are several things you can do to help prevent further action.

- Get in touch with your creditors as soon as possible and arrange a payment plan that works for both parties. If they’re willing, let them know that they should not contact the bailiff while negotiations are ongoing — and if they do, tell them directly that this is an attempt at harassment and will not be tolerated.

- Request a debt relief order (DRO). Your local county court may be able to grant one of these orders which protect your financial position by allowing payments over time instead of through lump sums or accruing interest on arrears until paid off fully; however, DROs do not prevent creditors from enforcing any judgment made against you by obtaining an execution upon it (that is where bailiffs come into play).

- You can call +44 7779648018 and request to stop bailiff action. Acme Credit Consultant will help you to stop bailif f at home.